Agronomy Update

Oct 30, 2025

The Bio Buzz: The Good, The Bad, and The Ugly

For the better part of a decade, the ag industry has been buzzing about biologicals. Many have touted it as the next major growth segment in agronomy, and to be fair, there is truth to that. The market has accelerated rapidly in the past 2 - 3 years, with more products, more investment, and more aggressive marketing than ever before. This article takes an honest look at biologicals - the good, the bad, and the ugly - so you can make sound, profitable decisions on your farm.The Good

Biological amendments are not new. In fact, most growers have already used one of the most successful biologicals ever developed: rhizobia inoculants. These products contain specific bacterial strains (rhizobia) that form symbiotic relationships with legumes such as soybeans, pulses, and dry beans, to form nodules and fix atmospheric nitrogen into plant-available forms. Their value is obvious to anyone who has ever seeded peas or lentils without inoculant and witnessed poor nodulation, stunted growth, and disappointing yields. In this case, the biology works - and it works consistently.Another proven example is the biological fungicide Contans® WG, which contains Coniothyrium minitans. Its mode of action targets sclerotia, the overwintering structures of the white mold pathogen, in crops like canola, dry beans, and soybeans. While it does not eliminate white mold, it has shown it can reduce inoculum levels and make the disease more manageable over time when paired with a sound fungicide program. These tools demonstrate that biologicals can play a legitimate and valuable role in agronomy.

The Bad

The challenge is that the biological industry has also become a bit of a wild west. Many products claim to “unlock nutrients,” “release tied-up fertility,” or “add nitrogen to the soil,” often with little more than glossy marketing behind them. There is no single regulatory body that enforces label transparency, so companies can list strains without disclosing concentration, subspecies, or viability - details that matter tremendously in biological efficacy.To make things even murkier, some products do work under specific environments, while many others simply don’t live up to the hype. This inconsistency is where the risk lies. A high-margin biological might sell strongly for a couple years on promises and testimonials, only to quietly disappear when the results don’t show up in the field. By then, growers have spent real money on products that never delivered real ROI.

The Ugly

Two issues stand out as truly concerning. The first is the constant repackaging of underperforming products. Instead of discontinuing a biological that hasn’t proven itself, companies often roll out Version 2, 3, 4, and beyond - assuring growers that the “new formulation” will finally deliver. This preys on the instinct all farmers share: the drive to improve. But in reality, it often feels like kicking the can down the road, benefiting the seller more than the farmer.The second issue is the agronomy that follows these products. Some labs or consultants promote “unlocking soil nutrients” through biological fertility approaches that conveniently require using their products while reducing conventional fertilizer. Before buying into this idea, growers should ask hard questions:

- Is the system proven across environments - not just in slideshows?

- Does it make economic sense?

- Are independent university results backing it up?

Meanwhile, biological fertility systems rarely show repeatable success across locations or years. When the outcome is inconsistent, the economic gamble is real.

Conclusion

Being skeptical of biologicals does not make a grower old-school or closed-minded. It makes them responsible. Traditional agronomy may not always be flashy, but it is proven, repeatable, and grounded in decades of research. Biologicals can have a place on the farm - especially when backed by science and used to complement, not replace, a sound fertility program.If you want to experiment, go into it with eyes wide open, ask tough questions, and demand proof of economic return. At the end of the day, your goal isn’t to follow buzzwords - it’s to grow profitable crops. Gambling belongs in Las Vegas, not in your fertility plan.

Kyle Okke, CCA

Agile Agronomy LLC & Agronomists Happy Hour Podcast

2025 Flax Variety Trial Results

With difficult market conditions flax has been a bit of a bright spot this fall both in terms of price and yields. Flax acres in North Dakota have been on the decline from a high of 890,000 acres in 2005 to 95,000 acres in 2024. Yield in the early 2020s trended around 20 bu/A. With local yields in the mid to upper 30s and even low 40s in 2025, it seems likely we will see an expansion of flax acres in 2026. Those who didn't grow flax this year will be in the market for seed and trial results recently published recently by the NDSU Dickinson Research Extension Center provides some useful yield information for variety selection.The top yielding brown flax variety in the 2025 trial was York at 41 bu./ A, outperforming ND Hammond (34 bu./A) and CDC Rowland (34 bu./ A). AAC Marvelous, CDC Kernen, CDC Neela, CDC Glas and Webster weren't far behind York at 38 to 39 bu./A.

While York led the trial this year, it has been inconsistent across seasons, ranking near the bottom in both 2023 and 2024. ND Hammond and Webster also recorded lower yields in those years. York (released in 2002) and ND Hammond (2018) are both NDSU-developed varieties, while Webster (1998) originated from South Dakota State University.

The CDC varieties Glas, Kernen, and Neela along with AAC Marvelous performed consistently at the top across all three study years. Out of those four, CDC Kernen was the earliest maturing at 96 days to maturity and AAC Marvelous was the longest at 103 days to maturity in 2025. CDC Kernan, Neela and Glas all fell between those two at 99 to 100 days.

CDC Glas, Kernen, Rowland, Neela and AAC Marvelous are described as being moderately resistant to Fusarium wilt and powdery mildew, and resistant to rust. York is resistant to rust and has good tolerance to flax wilt. ND Hammond is described as resistant to flax wilt. Neither ND Hammond nor York are resistant to powdery mildew.

CDC Kernen was the newest release from the University of Saskatchewan breeding program included in this trial and was registered in 2021. CDC Esme, registered in 2023, was not evaluated in this trial but seems to perform fairly similarly to CDC Rowland in terms of yield and maturity from data provided by SeCan. CDC Rowland, registered in 2018, was the top variety grown in Saskatchewan in 2024. Hopefully we will have ND trial data in the future to make a side by side comparison with CDC Esme.

CDC Rowland is carried by ND Crop Improvement and available from the NDSU Williston Research Extension Center. AAC Marvelous and CDC Neela are licensed by Meridian Seeds. While the 2025 field seed directory has not yet been released, growers can refer to the ND State Seed website carryover directory to see what is currently available.

Dr. Audrey Kalil

Agronomist/Outreach Coordinator

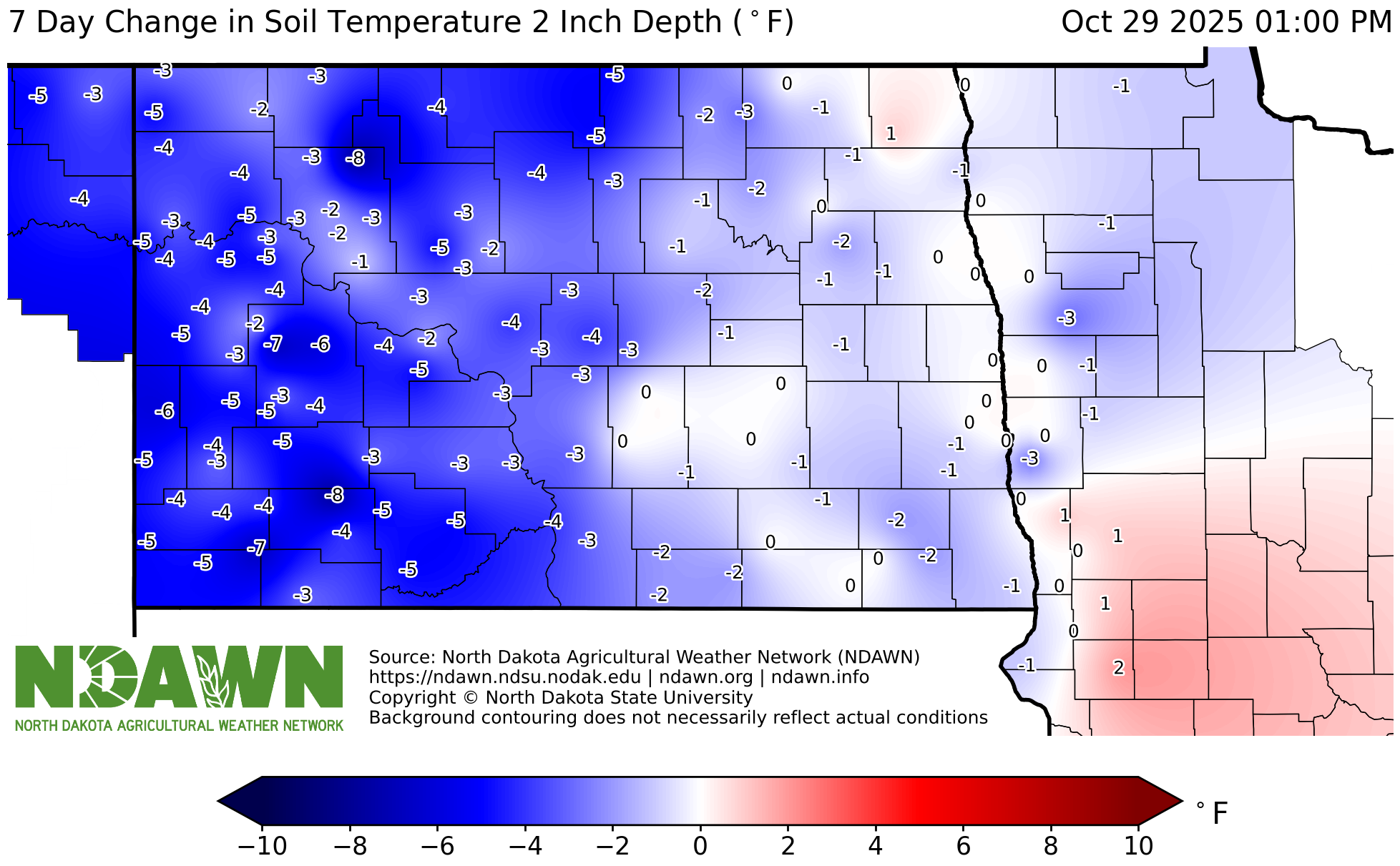

Climate and Soil Conditions Update

Changes in soil water content over the past week (brown = drier, teal = wetter)